Clearing and Settlement of Custody Accounts

The Custodian System was applied as of January 2, 2006 to enhance the role of custodian in the market. The custodian can identify and establish accounts for his clients, safe-keep their securities, transfer deposited securities between accounts, enquire about the movements and balances of his clients' deposited securities and release securities to the selling broker and receive securities from the buying broker on behalf of his clients.

On 01/10/2017, the SDC introduce the custodians to the settlement, therefore, this system allows them to settle the trades of their clients directly with the SDC on a delivery-versus-payment (DvP) basis.

Thus, the settlement between the broker and the custodian are as follows:

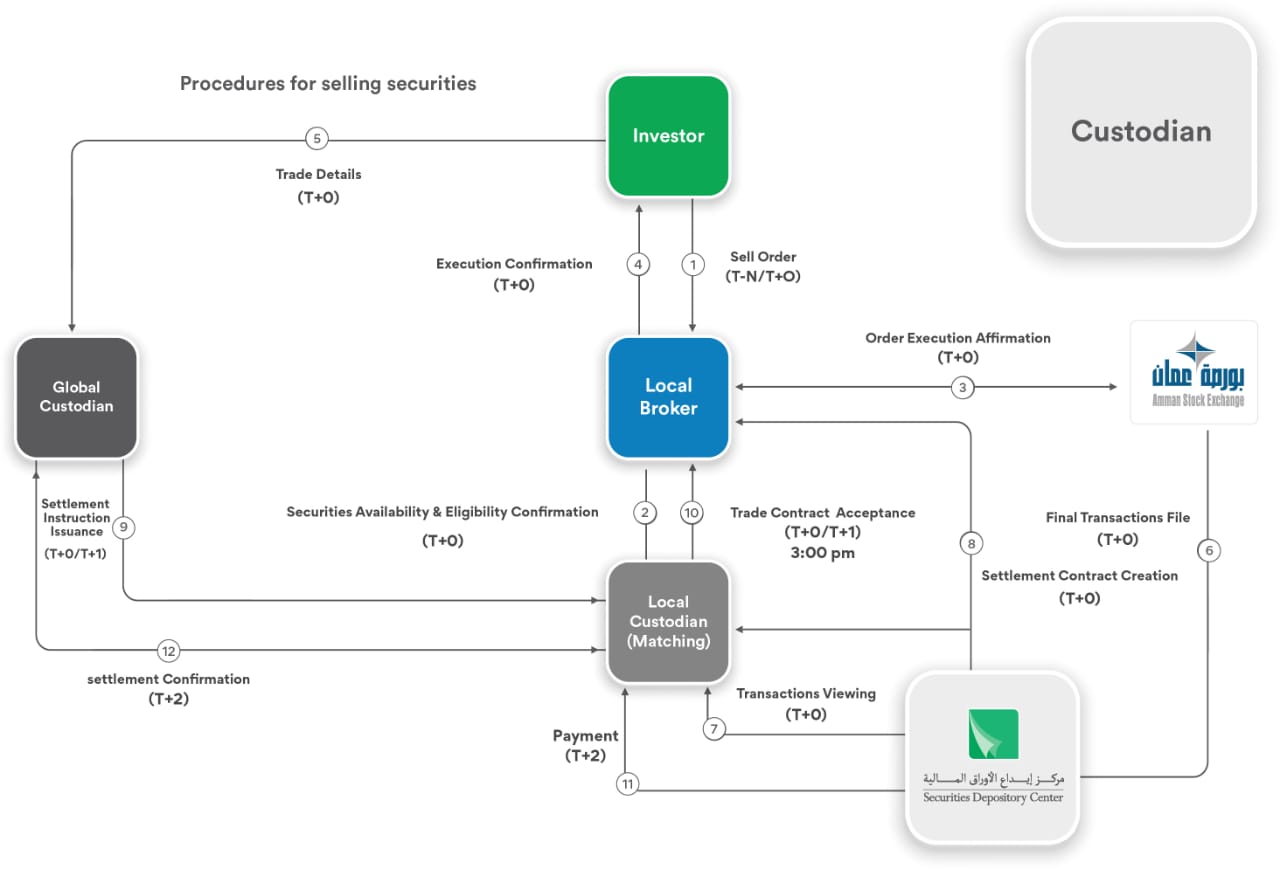

A. Buy Side:

| 1. | (T-N) or (T+0) The investor instructs local broker to buy securities. |

| 2. | (T+0) The local broker executes order and receives affirmation from Amman Stock Exchange. |

| 3. | (T+0) The local broker confirms trade execution to investor. |

| 4. | (T+0) The Investor informs global custodian of trade details. |

| 5. | (T+0) The ASE provides the SDC with the final transactions file after the end of the trading session. |

| 6. | (T+0) The local custodian views transactions conducted on behalf of their clients electronically. |

| 7. | (T+0) The SDC creates buy settlement contract between local broker and local custodian. |

| 8. | (T+0) or (T+1)The global custodian issues settlement instruction to the local custodian. |

| 9. | (T+0) or (T+1)Until 3:00 pm, the local custodian accepts the settlement contract which represents an obligation to settle the trade with the SDC. |

| 10. | (T+2) The local custodian pays the value of the bought securities. |

| 11. | (T+2) The SDC registers the ownership of bought securities in the investor’s account at the local custodian. |

| 12. | (T+2) Settlement between local custodian and global custodian. |

It is worth mentioning that in case the local custodian rejects the trade (buy), the concerned broker is obliged to settle the trade with the SDC.

The following chart represents the procedure of buying securities:

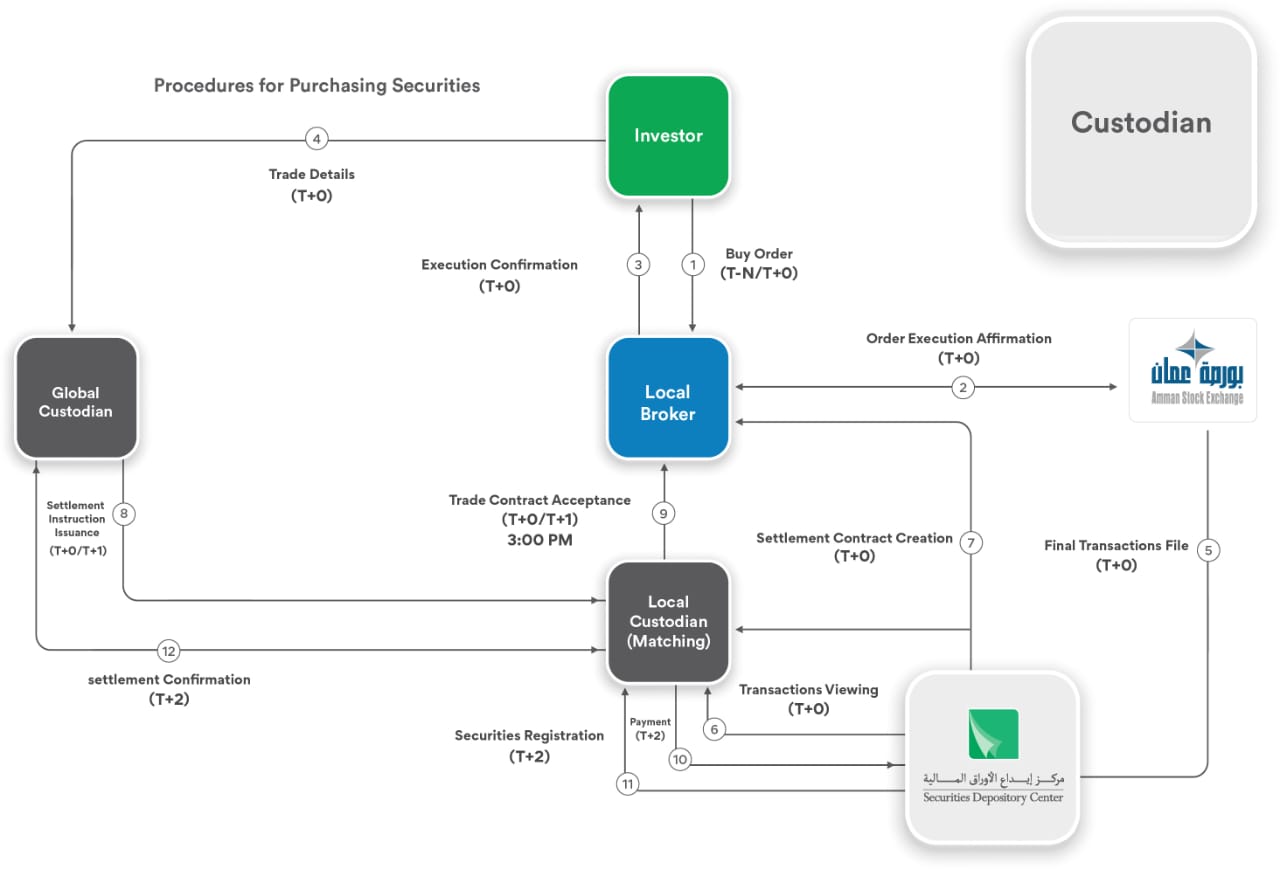

B. Sell Side:

| 1. | (T-N) or (T+0) The investor instructs local broker to sell securities. |

| 2. | (T+0) The local broker confirms securities availability and eligibility with local custodian. |

| 3. | (T+0) The local broker executes trade & receives affirmation from Amman Stock Exchange. |

| 4. | (T+0) The local broker confirms trade execution to investor. |

| 5. | (T+0) The investor informs global custodian of trade details. |

| 6. | (T+0) The ASE provides the SDC with the final transactions file after the end of the trading session. |

| 7. | (T+0) The local custodian views transactions conducted on behalf of their clients electronically. |

| 8. | (T+0) The SDC creates sale settlement contract between local broker and local custodian. |

| 9. | (T+0) or (T+1) The global custodian issues settlement instruction to the local custodian. |

| 10. | (T+0) or (T+1) Until 3:00 pm, the local custodian accepts the settlement contract which represents an obligation to settle the trade with the SDC. |

| 11. | (T+2) The local custodian pays the value of the sold securities. |

| 12. | (T+2) Settlement between local custodian and global custodian. |

It is worth mentioning that in case the local custodian rejects the trade (sell), the concerned broker is obliged to settle the trade with the SDC.

The following chart represents the procedure of selling securities: