Clearing and Settlement of Securities

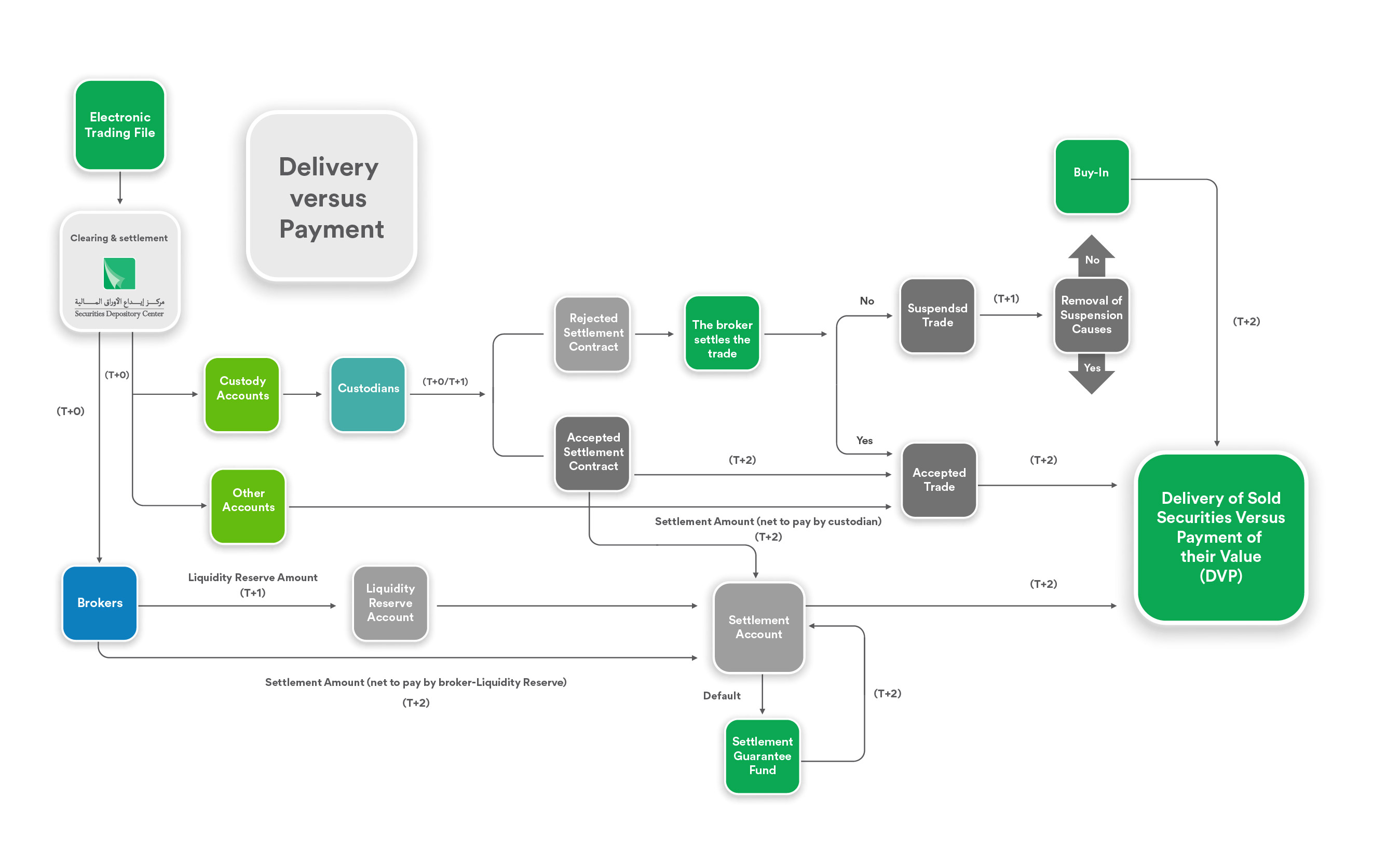

The process of clearing and settlement of securities is conducted to receive and pay the prices of securities resulted from trading contracts executed in the Amman Stock Exchange. At the end of each day, the SDC calculates the net rights and obligations of brokers and custodians resulting from trading and notifies them electronically in the SDC's systems dedicated for brokers and custodians. Accordingly, the SDC settled these contracts and transferred the ownership based on the set deadlines. The clearing and settlement is done on the basis of Delivery versus Payment. This principle is considered an important international standard applied in the capital market

conducted to receive and pay the prices of securities resulted from trading contracts executed in the Amman Stock Exchange. At the end of each day, the SDC calculates the net rights and obligations of brokers and custodians resulting from trading and notifies them electronically in the SDC's systems dedicated for brokers and custodians. Accordingly, the SDC settled these contracts and transferred the ownership based on the set deadlines. The clearing and settlement is done on the basis of Delivery versus Payment. This principle is considered an important international standard applied in the capital market

Financial settlements between brokers and custodians are conducted through the SDC by fund transfers from the brokers' and custodians' accounts to the SDC Settlement Account at the Settlement Bank. Consequently, the SDC transfers those funds to the brokers and custodians who should receive funds through SWIFT. The Central Bank of Jordan -CBJ was chosen as the Settlement Bank. The SDC has joined the Society for Worldwide Interbank Financial Telecommunication (SWIFT), thus, the SDC has become a direct member of the Real Time Gross Settlement System (RTGS-JO) which is managed by the CBJ.

The SDC conducts the clearing process to determine the amounts that the broker must pay or receive in accordance with all the trading contracts executed by the concerned broker and the settlement contracts accepted by the custodians. This is done by subtracting the total amount of buying trading contracts and selling settlement contracts from the total amount of selling trading contracts and buying settlement contracts for the trading day and the broker is notified electronically of the amount due. The amount that the broker must pay is divided into:

- The Liquidity Reserve amount that is paid on (T+1), which represents the amount to be paid to the broker on (T+0) subtracting half his collateral in the Settlement Guarantee Fund (cash contributions and bank guarantee)

- The settlement amount (T+2), which represents the difference between the net to pay and the Liquidity Reserve amount that is paid on (T+1).

If the broker does not pay the Liquidity Reserve amount or the settlement amount within the specified timeframes, he is considered in breach of his obligations and the SDC takes the necessary measures to fulfill the financial settlement through the Settlement Guarantee Fund.

Whereas the SDC conducts the clearing process to determine the amounts that the custodian must pay or receive in accordance with all the settlement contracts accepted by the concerned custodian by subtracting the total amount of selling settlement contracts from the total amount of buying settlement contracts for the trading day

The Custodian is notified electronically of the amount due to be paid or received by him. If the Custodian does not pay the settlement amount within the specified timeframes, he is considered in breach of his obligations and the SDC takes the necessary measures to fulfill the financial settlement through the Settlement Guarantee Fund

(To view the Clearing and Settlement of Custody Accounts, click here)